How Valenti Partners Supports Entrepreneurs and Businesses Worldwide

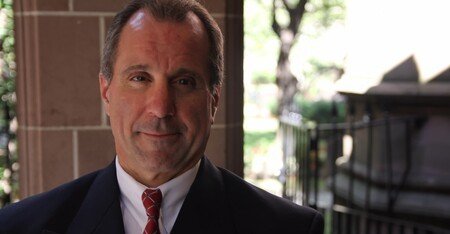

Dominick M. Valenti has been running Valenti Partners LLC since 1991. With over 40 years of experience as an investment banker, he provides key insights, expertise, and comprehensive advice to clients on important aspects of local and international economics, personal finances, and financial planning. Valenti Partners is highly regarded in the financial industry due to their methodologies, […]

How Valenti Partners Supports Entrepreneurs and Businesses Worldwide Read More »